does nh have food tax

New Hampshires individual tax rates apply. The New Hampshire income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

The income tax rates are graduated with rates ranging from 58 to 715 for tax.

. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Is New Hampshire a good tax state.

You can learn more about how the New Hampshire income tax compares to other states income taxes by visiting our map of income taxes by state. New Hampshire Beer Tax - 030 gallon New Hampshires general sales tax of NA does not apply to the purchase of beer. You generally need to pay the dividends tax if your total gross interest and dividends was at least 2400 as a single filer or 4800 as a joint filer.

New Hampshire doesnt have an income tax. However currently theres a 5 tax on dividends and interest in excess of 2400 for individuals 4800. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

Delaware Montana Alaska Oregon and New Hampshire do not have state sales tax. Income Tax Range. This means that New Hampshire has amongst the.

In New Hampshire beer vendors. Does general sales tax apply. A 9 tax is also assessed on motor vehicle rentals.

There are however several specific taxes levied on particular services or products. The elimination of the tax. Maine generally imposes an income tax on all individuals that have Maine-source income.

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room. There is an individual. Alongside the State of Alaska New Hampshire is one of two states that have neither a state income tax nor a sales tax.

However each of these states regulates its own excise taxes income taxes and taxes on.

Week 4 Of The 2022 Session Kansas Health Institute

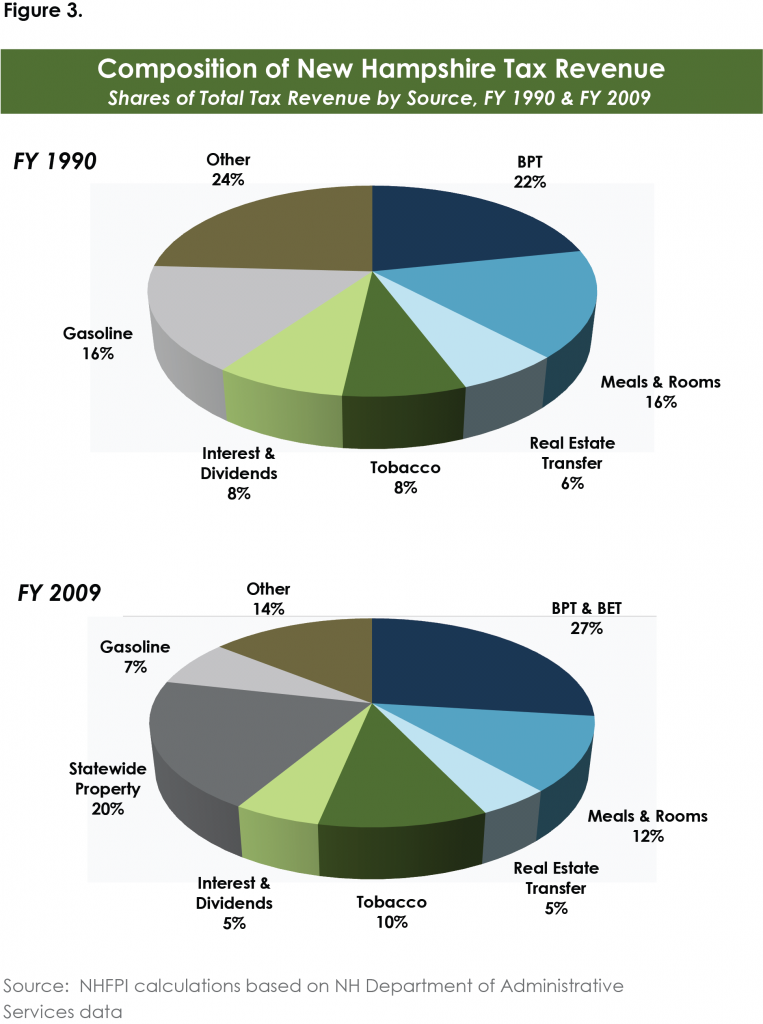

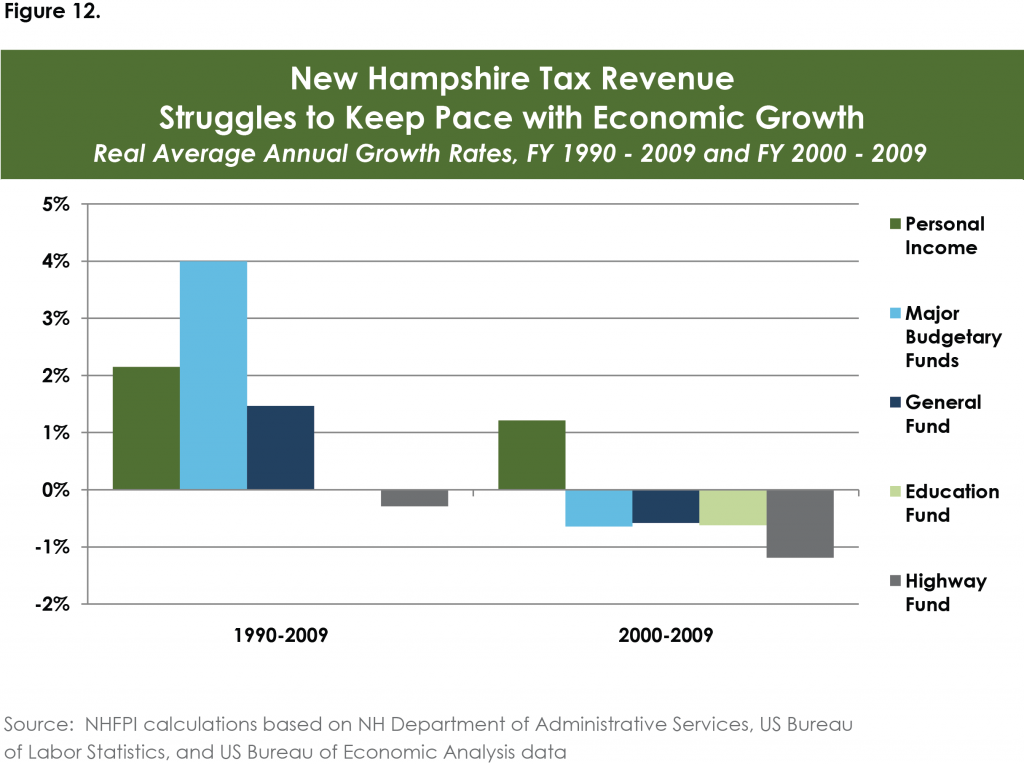

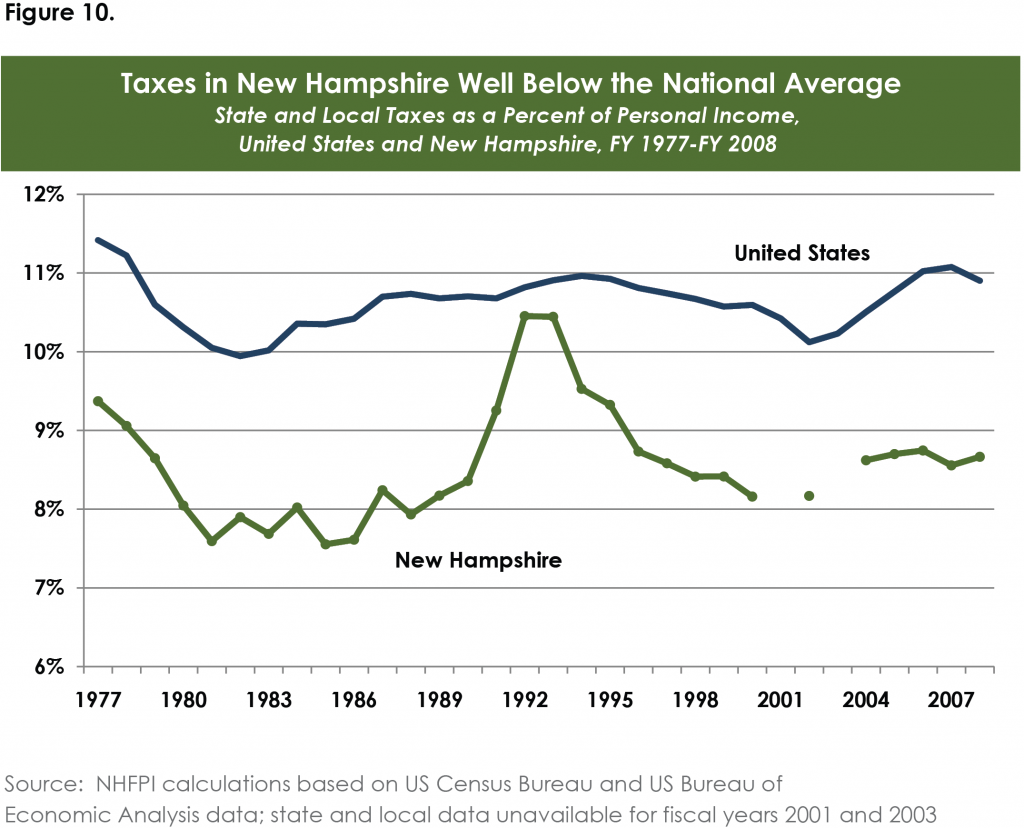

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

New Hampshire State Executive Offices Ballotpedia

States Without Sales Tax Article

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Biden S Federal Gas Tax Holiday Would It Help Or Hurt Nh Merrimack Nh Patch

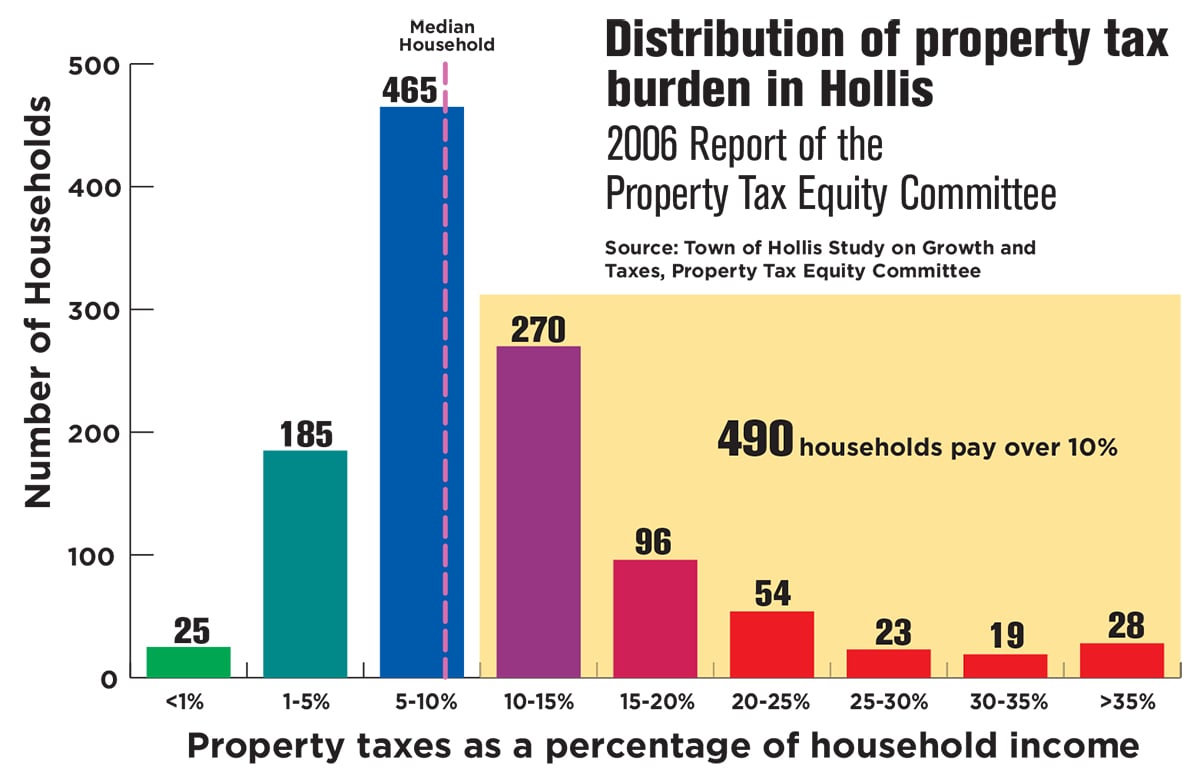

Does New Hampshire Love The Property Tax Nh Business Review

China Gourmet Restaurant Menu In Goffstown New Hampshire Usa

New Hampshire Sales Tax Rate 2022

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Maine Sales Tax Small Business Guide Truic

Online Menu Of Yanni Pizza Restaurant Hillsborough New Hampshire 03244 Zmenu

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)